A. Collecting financial data on a supplier is a critical step in supplier evaluation, ensuring they are financially stable and capable of fulfilling contractual obligations. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, analyzing financial data helps mitigate risks, supports strategic sourcing decisions, and ensures value for money in contracts. Below are three types of financial data, their purpose, and what they reveal about a supplier, explained in detail:

Profitability Ratios (e.g., Net Profit Margin):

Description: Profitability ratios measure a supplier’s ability to generate profit from its operations.

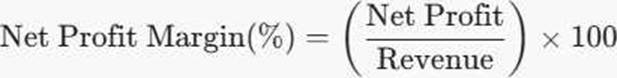

Net Profit Margin, for example, is calculated as:

This data is typically found in the supplier’s income statement.

What It Tells You:

Indicates the supplier’s financial health and efficiency in managing costs. A high margin (e.g., 15%) suggests strong profitability and resilience, while a low or negative margin (e.g., 2% or -5%) signals potential financial distress.

Helps assess if the supplier can sustain operations without passing excessive costs to the buyer.

Example: A supplier with a 10% net profit margin is likely stable, but a declining margin over years might indicate rising costs or inefficiencies, posing a risk to contract delivery.

Liquidity Ratios (e.g., Current Ratio):

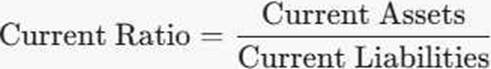

Description: Liquidity ratios assess a supplier’s ability to meet short-term obligations. The Current Ratio is calculated as:

This data is sourced from the supplier’s balance sheet.

What It Tells You:

Shows whether the supplier can pay its debts as they come due. A ratio above 1 (e.g., 1.5) indicates good liquidity, while a ratio below 1 (e.g., 0.8) suggests potential cash flow issues. A low ratio may signal risk of delays or failure to deliver due to financial constraints.

Example: A supplier with a Current Ratio of 2.0 can comfortably cover short-term liabilities, reducing

the risk of supply disruptions for the buyer.

Debt-to-Equity Ratio:

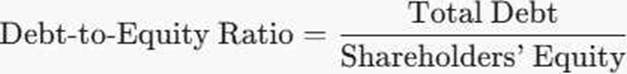

Description: This ratio measures a supplier’s financial leverage by comparing its total debt to shareholders’ equity:

This data is also found in the balance sheet.

What It Tells You:

Indicates the supplier’s reliance on debt financing. A high ratio (e.g., 2.0) suggests heavy borrowing, increasing financial risk, while a low ratio (e.g., 0.5) indicates stability.

A high ratio may mean the supplier is vulnerable to interest rate hikes or economic downturns, risking insolvency.

Example: A supplier with a Debt-to-Equity Ratio of 0.3 is financially stable, while one with a ratio of 3.0 might struggle to meet obligations if market conditions worsen.

Exact Extract Explanation

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes the importance of financial due diligence in supplier selection and risk management, directly addressing the need to collect and analyze financial data. It highlights that "assessing a supplier’s financial stability is critical to ensuring contract performance and mitigating risks," particularly in strategic or long-term contracts. The guide specifically references financial ratios as tools to evaluate supplier health, aligning with the types of data above.

Detailed Explanation of Each Type of Data:

Profitability Ratios (e.g., Net Profit Margin):

The guide notes that profitability metrics like Net Profit Margin "provide insight into a supplier’s operational efficiency and financial sustainability." A supplier with consistent or growing margins is likely to maintain quality and delivery standards, supporting contract reliability.

Application: For XYZ Ltd (Question 7), a raw material supplier with a declining margin might cut corners on quality to save costs, risking production issues. L5M4 stresses that profitability data helps buyers predict long-term supplier viability, ensuring financial value. Liquidity Ratios (e.g., Current Ratio):

Chapter 4 of the study guide highlights liquidity as a "key indicator of short-term financial health." A supplier with poor liquidity might delay deliveries or fail to fulfill orders, directly impacting the buyer’s operations and costs.

Practical Use: A Current Ratio below 1 might prompt XYZ Ltd to negotiate stricter payment terms or seek alternative suppliers, aligning with L5M4’s focus on risk mitigation. The guide advises using liquidity data to avoid over-reliance on financially weak suppliers.

Debt-to-Equity Ratio:

The guide identifies leverage ratios like Debt-to-Equity as measures of "financial risk exposure." A high ratio indicates potential instability, which could lead to supply chain disruptions if the supplier faces financial distress.

Relevance: For a manufacturer like XYZ Ltd, a supplier with a high Debt-to-Equity Ratio might be a risk during economic downturns, as they may struggle to access credit for production. The guide recommends using this data to assess long-term partnership potential, a key financial management principle.

Broader Implications:

The guide advises combining these financial metrics for a comprehensive view. For example, a supplier with high profitability but poor liquidity might be profitable but unable to meet short-term obligations, posing a contract risk.

Financial data should be tracked over time (e.g., 3-5 years) to identify trends―e.g., a rising Debt-to-Equity Ratio might signal increasing risk, even if current figures seem acceptable.

In L5M4’s financial management context, this data ensures cost control by avoiding suppliers likely to fail, which could lead to costly delays or the need to source alternatives at higher prices. Practical Application for XYZ Ltd:

Profitability: A supplier with a 12% Net Profit Margin indicates stability, but XYZ Ltd should monitor for declines.

Liquidity: A Current Ratio of 1.8 suggests the supplier can meet obligations, reducing delivery risks.

Debt-to-Equity: A ratio of 0.4 shows low leverage, making the supplier a safer long-term partner.

Together, these metrics help XYZ Ltd select a financially sound supplier, ensuring contract

performance and financial efficiency.

Reference: CIPS L5M4 Study Guide, Chapter 4: Financial Management in Contracts, Section on Supplier Financial Assessment and Risk Management.

Additional

Reference: Chapter 2: Performance Management in Contracts, Section on Supplier Evaluation.